The present hot topic for everyone is how best to curb the corporate and financial excesses and risky behaviour that lead most of the world's economies into the worst recession since the Great Depression. However, the '800 pound gorilla' in the room that this debate neglects is the lack of transparency that senior executives have over their operations and initiatives, and the perverse incentives this creates.

In the English-speaking world, key policymakers and the public at large have taken up the mantle of improving corporate governance, more specifically limiting corporate remuneration, as a way to check senior executives' and bankers' appetite for risky, even illegal, short-term profit maximising that can inject dangerous volatility into financial systems and markets.

In Australia, APRA recently proposed new executive compensation guidelines, and the ASX Corporate Governance Council is considering issuing guidelines that would require ASX-listed companies to maintain records of their briefings with analysts, provide advance notice and make them more widely accessible to provide for the more equal and fair dissemination of information.

In the UK, a recently published government-commissioned report on corporate governance by Morgan Stanley senior adviser David Walker recommends that banker pay be awarded on a long-term basis and would subject banker bonus payments to close public scrutiny. In the US, there is a compensation 'czar' tasked by the US Treasury to reign in senior executive compensation at companies that received government bailout funds.

I can see and appreciate the logic in addressing the perverse incentives that currently reside within executive and banker compensation structures. But, this is only one side of the equation. The other side involves the fact that senior executives within many organisations can not clearly and accurately identify, measure, and manage their internal costs and value-creation activities.

Unfortunately, in many instances, senior management is making important strategic and investment decisions based on experience, 'gut feels', and/or short-term, known measures, such stock price and personal compensation targets - which in the US, especially, normally consists of stock and option grants. Arguably, this inability to identify, measure and manage organisational costs and benefits encourages senior management to focus more on more short-term, tangible performance metrics (i.e., personal remuneration targets) at the expense of longer-term initiatives whose benefits are at best uncertain.

At mbh, we regularly provide technology solutions and consulting services to organisations that lack the internal processes and technology for clear assessment of operational costs and the value potential of initiatives. We developed our web-based, enterprise project portfolio management software solution, UniPhi, to address what we see as an alarming lack of operational and strategic transparency within most organisations.

We believe that any organisation with 100 or more people should adopt an enterprise-level project portfolio management system to provide greater transparency of operational costs and the initiatives most likely to add, or destroy, value. By equipping senior executives with this knowledge, they will be more inclined to behave in the interests of the organisation, because they'll have a better understanding of what is really happening and can take appropriate steps.

In addition, this greater transparency allows for better accountability, since the information resides within the project portfolio management system for the entire organisation to see. This should dramatically lessen management's incentives to engage in short-term, self-serving, and possibly illegal, activities, since the possibility of disclosure is heightened.

A project portfolio management system also assists the Board of Directors in carrying out their oversight duties, given they will have a much better grasp of what is occurring within an organisation at the strategic and operational levels. This system also assists in accurate public financial reporting, since everyone across the organisation will be working from the same set of financial data.

For many organisations, this increased transparency may fell like an uncomfortable 'shock' to the system. However, it is much more preferable than having politicians manage your organisation after some catastophe. Just ask Bank of America, who is paying back its bailout funds early, because it believes the US Treasury's executive compensation restrictions prevent it from attracting a qualified successor to its outgoing CEO.

Enterprise project portfolio management may not be the proverbial 'silver bullet' for the corporate governance problem, but it definitely enhances internal corporate transparency, and thus accountability, which is a step in the right direction.

Friday, December 04, 2009

Sunday, October 18, 2009

banks and managers as agents for owners

It's going to be a very interesting 12 months in relation to bank profits. The profit made by Goldman Sachs and the quick return of smugness in the industry is a fascinating example of arrogance that completely destroys self reflection. I'm hoping the jury is still out and that someone within the industry will pull the various egos in a room, bang their heads together and then some sense ensues. The banks have generated such a phenomenal amount of destruction to market based capitalism it is one of life's great examples in arrogance in ignorance. The biggest challenge to market based capitalism for me is the challenge that banks bonuses paid to employees has proven beyond a doubt the importance of owner based management. In fact Adam Smith asserted that self interest will be guided by the invisible hand to generate public good only if the owner is also the manager. Of course, the leverage of the manager being an agent for the owner is crucial to modern market economies but the abuse of this agency power by bank employees has thrown all the benefits of this leverage to the wind.

So, lets see how the public reacts to this new arrogance of the banks that has occured so soon after these same bankers were on their knees begging the public for help.

Saturday, September 12, 2009

doing business in developing countries

The latest issue in China with Mr Hu being arrested on "espionage" charges has generated a number of thoughts for me. Since 2006 I have been working with various people in the Australian cattle industry to generate markets for our marvellous cattle genetics and breeding knowledge. The important note here as background information (for blogs to be written later) is that the product is knowledge. To date, the success has been in the sale of physical seed stock both to China in the form of dairy seed stock and Russia in the form of beef seed stock. To call it a success is to have a very low hurdle for success but is made on the basis of the difficulties in opening up new markets in developing countries with more complex political systems.

I'm not sure about other countries but I have first hand experience of the two countries mentioned; China and Russia. These two countries are incredibly hard places to do business. The rules are so different to Australia that Australian businessmen can never confidently do business in these countries and are in constant peril of selling their souls to get the job done (as an example, IKEA has finally decided that it's best to stop investing in Russia....for now http://www.businessweek.com/globalbiz/blog/europeinsight/archives/2009/06/ikea_turns_sour.html).

The contradiction with all this is that both China and Russia are such beautiful countries and in terms of business have so much potential. I presented to the Russian Agricultural Minister in 2006 a proposal for Australia to export USD300m worth of Beef seedstock and USD300m worth of knowledge and infrastructure development. The research and planning that went into this proposal was massive and the strategy was snapped up by the Russian government. Within 3 months they had ordered massive amounts of seedstock breeders from Britain! Fortunately an outbreak of foot and mouth in Britain killed the deal, but why did Russia take our proposal and run to Britain with it. Since this time, I have seen versions of my proposal (even word for word) in a variety of different Russian business proposals to the Ministry for funding. However, support in Australia for doing business in Russia (and more particularly, on selling our cattle IP) is difficult to obtain. Elders have sold some shipments to Russia since my proposal but the on-sell of services hasn't occurred and the numbers of cattle are far short of what they could be. I do know that Rural Solutions in Adelaide are working on some great proposals for the Russian regions but again, little has come of it in terms of hard core investment by the Russian government.

The story is little different in China. The Australian beef cattle industry has been battling for years to get some traction in developing China's beef production with not a single sale to show for it. My experience and conversations I've had with others has given me first hand anecdotes of the frustrations businesses seem to have in operating in these countries. In Russia, corruption seems to significantly reduce the amount of investment and hence the growth that's possible. In China, the ever present oversight of government control makes it extremly difficult to utilise traditional marketing practices of differentiation and segmentation to make headway. It's more about connections and alignment to the current central plan. And yet, China continues to boom and with their switch from exports to internal infrastructure investment, looks like continuing to boom.

It seems that most people think that establishing operations in these great and populace countries is just too hard, and my suspicion is that the Hu case is only going to make this perception more entrenched, much to the disadvantage of all the world over.

Sunday, July 26, 2009

energy

There's been much debate and blogging time being spent on the need for political action to prevent global warming but I wonder how much positive impact politicians can make in this area. It's highly likely that politics can slow down the transition to "clean" energy (today's clean energy will be tomorrow's pollutants as we run out of silicon, lithium and other essential ingredients). However, can legislation really speed up the natural progression to this new energy world? Maybe the world would transition quicker if the world's politicians managed to negotiate a policy framework that priced carbon dioxide effectively but when in history have politicians been able to legislate a market price?

The articles referenced at this blog http://peakenergy.blogspot.com/2009/07/monumental-failing.html (a great consolidator of information by the way) demonstrate my point. It is unrealistic to think that politicians will create a world wide policy framework that will abate the affects of global warming. However, it is less unrealistic to think that the natural reduction in the cost of renewables will drive a far quicker transition through market forces than any policy ever could. Energy is the largest industry in the world and the opportunity to get a slice of this industry into the future means that there will be millions of people world wide trying to invent product. Barriers to entry were massive while oil and coal dominated the landscape, but now, these barriers have been lowered (mainly by the success of renewables supported by the focus on issues such as global warming and peak oil). New players will emerge while the encumbents scramble to change their business models and resist the transition as much as possible. These encumbents are powerful, but political incompetence may actually be hindering them even while their lobbying efforts continue to have a significant effect.

In fact, Alan Kohler's article shows how political incompetence could actually assist more than political competence. The strain that the uncertainty caused by a garbled CO2 policy has put on the coal industry is in fact having the same effect as a carbon price would. Coal fired plants are now being viewed as expensive due to their uncertain future. This will drive investment in solutions and because the coal industry is finally being hindered in competing for these solutions, less money will be wasted on the fanciful idea of carbon capture.

Thursday, July 09, 2009

proposal writing

It's been a bad week for mbh this week. We've missed a number of proposals we'd submitted and with staff either sick or on leave, it's taken all our experience in prioritisation and workload management to make sure we keep supporting our clients to the same extremely high standard they've come to expect. Still for every bad week there tends to be a good one so after a couple of days of reflection, I'm now in the lessons learnt phase of the week. I always tend to learn more from things that go wrong than right.

This week's lessons are around proposal writing and having just finished a proposal 15 minutes ago ( and having committed to maintaining this blog) I thought I'd sign in and write down some random thoughts. After finishing the proposal, I asked my partner to have a read and give me her thoughts. Thankfully, she has far superior intellect than me and her communications degree certainly assists in challenging my arguments. Her comment this time related to the use of the term "hot" when referencing a product that is doing well at the moment. We have a four hour project planning course that takes people through a crash course in critical path analysis and network crashing. This course is very popular at the moment and I referenced this in the proposal as a "hot" product. My partner's challenge was "is this formal enough for a proposal" and my response at the moment is yes for when you are competing in bloody red ocean (which we are when it comes to PM training), one has to differentiate yourself as much as possible. However, as always, the doubts creep in.

Thoughts please, is using the term "hot product" too informal for a business proposal?

This week's lessons are around proposal writing and having just finished a proposal 15 minutes ago ( and having committed to maintaining this blog) I thought I'd sign in and write down some random thoughts. After finishing the proposal, I asked my partner to have a read and give me her thoughts. Thankfully, she has far superior intellect than me and her communications degree certainly assists in challenging my arguments. Her comment this time related to the use of the term "hot" when referencing a product that is doing well at the moment. We have a four hour project planning course that takes people through a crash course in critical path analysis and network crashing. This course is very popular at the moment and I referenced this in the proposal as a "hot" product. My partner's challenge was "is this formal enough for a proposal" and my response at the moment is yes for when you are competing in bloody red ocean (which we are when it comes to PM training), one has to differentiate yourself as much as possible. However, as always, the doubts creep in.

Thoughts please, is using the term "hot product" too informal for a business proposal?

Wednesday, July 08, 2009

strategy execution

Over the years, this blog has been poorly maintained. One of the frustrating things is feeling constrained in being able to write the things I verbally comment on during the day. I'm a fairly argumentative person and have strong and passionate views. These views can land you in hot water if you don't think them through. When speaking, there's always the feedback loop from the listener in the form of them replying but also in terms of their body language that assists me to determine if I'm going too far. On the web, through a blog, this is much different. However, there is the opportunity to reach a far wider audience and obtain some validation or repudiation on thoughts and ideas. So, I am determined to make another attempt at regular blogging. On this occasion, my blogs will be less researchy "white papers" and more just random thoughts and observations about what happened during the day.

Any thoughts?

Sunday, January 04, 2009

what happens when a company achieves its vision?

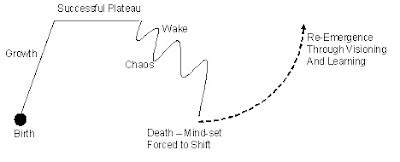

One of the interesting things that is commented on in change management texts and can be observed as a frequent phenomena for nearly every company that has ever succeeded is the plateau and slow decline that occurs once they have achieved what it was that they originally set out to achieve. This diagram below best illustrates what I'm talking about:

This graph demonstrates the linear growth trajectory of a successful start-up. However, once the initial vision has been reached and the product range that supported that vision is no longer unique, success plateau's and finally starts to fall. During this contraction phase, a serious of wake-up spikes occur where management reacts to the fall and tries new strategies to re-invigorate the company. However, the loss of an end state (see previous post) means that none of these periods last very long and are always followed by an even sharper fall. Finally, pending doom either results in bankruptcy and death or the re-emergence through a new vision and new mind-set of the organisation. Of course, there are many permutations in how these events take place, but in each permutation the overriding problem of a loss in ends state or vision driving failure. Often it is hard for the original successful organisation to let go of its sacred cows. These are, after all, the things that made them successful in the first place. But, ultimately, what will make the company grow again is an organisation the barely resembles the original at all. Some examples of this may help:

Having nearly died at the end of the 90s, IBM re-invigorated itself to the point where it no longer manufactures computers and makes nearly all its revenue from IT services and software(who would have thought that in the 80s).

Apple went through a tortuous period during the 90s and nearly went out of existence before its original founder created a new vision for the company centred around sleek design that has led to the iPod, iPhone and even a re-emergence of its original Mac product.

Apple went through a tortuous period during the 90s and nearly went out of existence before its original founder created a new vision for the company centred around sleek design that has led to the iPod, iPhone and even a re-emergence of its original Mac product.

Yahoo is currently going through a period of chaos centred around identity (will it re-emerge or die)?

General Motors is representative of the automotive industry in general but as been slower to respond. It is going through a period of chaos centred around a lack of vision now that its big is beautiful vision has been cast aside by society. Will it re-emerge along with the automotive into the new world of electric powered automobiles. There's no doubt in my mind that this is the vision to aspire to in the automotive industry and several organisations have taken up the challenge of meeting this all electric vision (e.g. Better Place, Nissan etc). Progress has been remarkably rapid due to their commitment to a vision they know is real.

What can we learn from this? The truth is that it is difficult to move a big ship once its course has been set and if you don't set a new destination once you reach the original one, you will fail. However, methodologies and tools to do this re-alignment are few on the ground. We have some ideas but are yet to really test them in the marketplace. Any thoughts?

Subscribe to:

Posts (Atom)